Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240509/16/original_fdd99bea-6eee-44a1-a7b2-ae1b0f5bb9f9.png)

Some Highlights

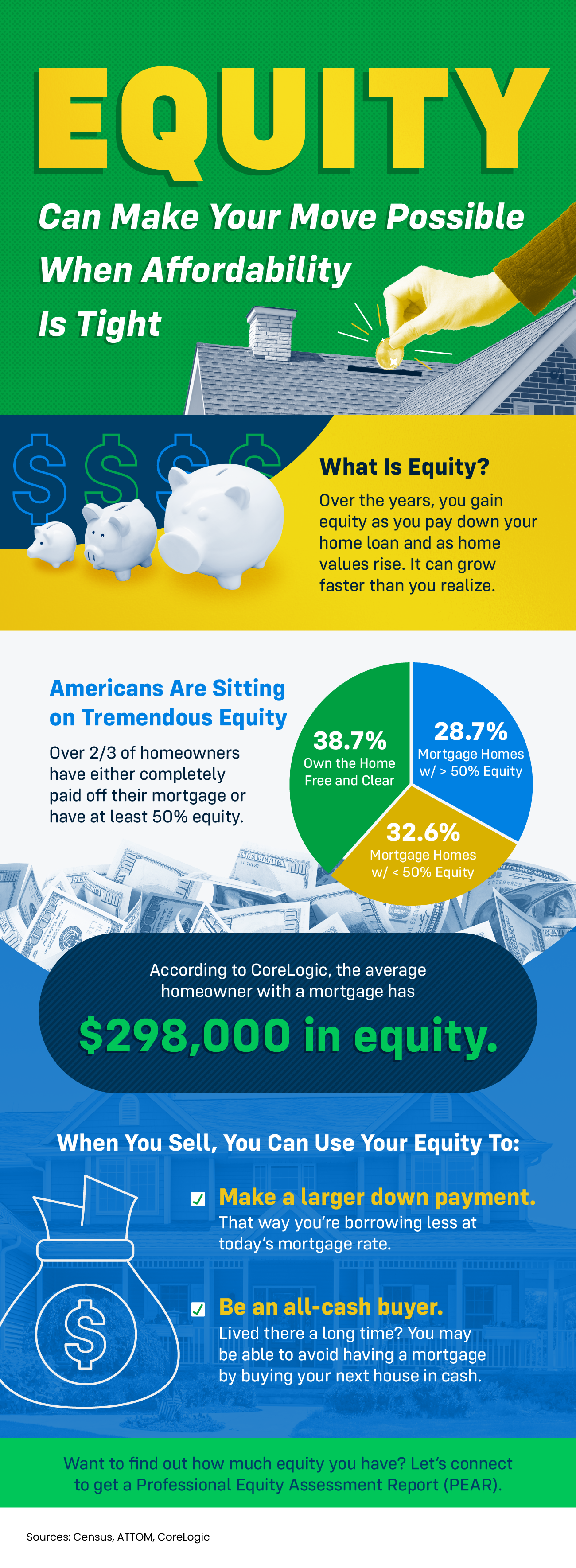

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

Recent Posts

LPST E-Newsletter

Your Roadmap to Homeownership

How Buying or Selling a Home Helps Your Local Economy

What You Need To Know About Homeowner’s Insurance

Is It Time To Put Your House Back on the Market?

Rising Inventory Means This Spring Could Be Your Moment

What You Need To Know About Pre-Approval

Is the Housing Market Starting To Balance Out?

Buying Your First Home? It’s Okay To Feel Nervous

Mortgage Rates Hit Lowest Point So Far This Year